14/04/ · If you risked 2% you would still have $18, If you risked 10% you would only have $13, That’s less than what you would’ve had even if you That’s why the 2% risk rule is very important in trading. Losing only 2% per trading means that you must maintain 10 consecutive trading losses to lose 20% of your account. Even if you suffer 20 losses in a row, your total capital intact is 60% 2% Rule Definition

2% Rule Definition

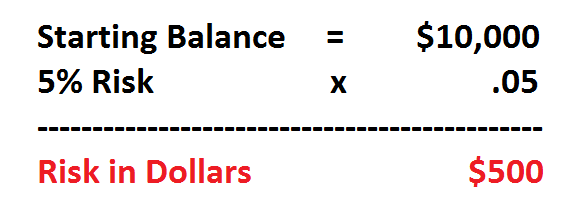

Brokerage fees for buying and selling shares should be factored into the calculation in order to determine the maximum permissible amount of capital to risk. The maximum permissible risk is then divided by the stop-loss amount to determine the number of shares that can be purchased. By knowing what percentage of investment capital may be risked, the investor can work backward to determine the total number of shares to purchase. The investor can also use stop-loss orders to limit downside risk.

For instance, an investor may stop trading for the month if the maximum permissible amount of capital they are willing to risk has been met. In practice, traders must also consider slippage costs and gap risk, forex 2 percent rule.

Risk Management. Your Money. Personal Finance. Your Practice. Popular Courses. Compare Accounts. Advertiser Disclosure ×.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Unlimited Risk Definition and Example Unlimited risk is when the risk of an investment is unlimited, although steps can be taken to help control actual losses. One-Cancels-All Order Definition A one-cancels-all order is a set of multiple orders placed together. If one order is triggered in full, the others are automatically cancelled, forex 2 percent rule.

Autotrading Definition Autotrading is a forex 2 percent rule plan based on buy and sell orders that are automatically placed based on an underlying system or program. Blow Up Blow up is a slang term used to describe the very public and amusing financial failure of an individual, corporation, bank, or hedge fund.

What is Investment Position Sizing? Position sizing refers to the size of a position within a particular portfolio, or the dollar amount that an investor is going to trade. Partner Links. Related Articles. Risk Management Limiting Losses. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice.

Investopedia is part of the Dotdash forex 2 percent rule family.

7.0 How to use 2% trading rule in money management

, time: 3:51

That’s why the 2% risk rule is very important in trading. Losing only 2% per trading means that you must maintain 10 consecutive trading losses to lose 20% of your account. Even if you suffer 20 losses in a row, your total capital intact is 60% 2% Rule Definition 14/04/ · If you risked 2% you would still have $18, If you risked 10% you would only have $13, That’s less than what you would’ve had even if you

No hay comentarios.:

Publicar un comentario