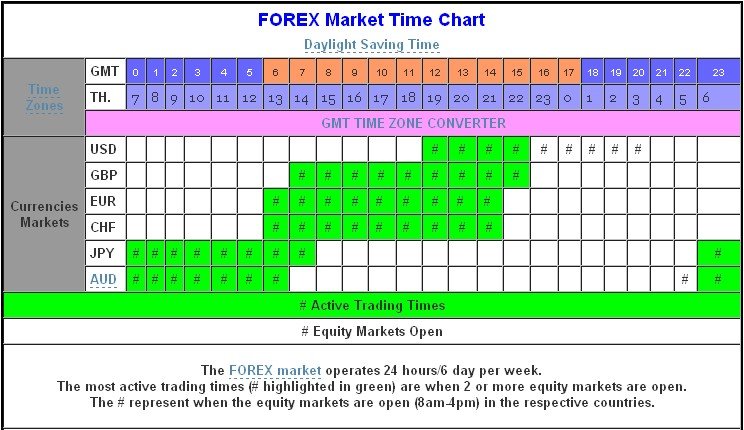

· Forex supply zones are areas where banks and institutions are placing a large number of sell positions at a particular price zone. If a portion of these sell orders remain unfilled when price moves lower, then they’re likely to be left there, just sitting untouched Forex Market Center Time Zone Opens GMT Closes GMT Status; Frankfurt Germany: Europe/Berlin: AM May PM May Closed: London Great Britain: Europe/London: AM May PM May Closed: New York United States: America/New_York: PM May PM May Closed: Sydney Austrailia: Australia/Sydney: PM 02 See the forex market hours and trading sessions in your local time. 5 city zones over 3 sessions. Asian Session: Sydney, Tokyo. European Session: Frankfurt, London. US Session: New York

Forex Zone | Forex Forum - Index

Because my hunch is that there are more trend following and momentum trading traders and strategies than there are range trading strategies, forex zones. And many of them only have one trading system to trade on the markets. Imagine using a momentum strategy when in fact the market is ranging. Even seasoned traders fall victim to this, forex zones. We see the chart being neutral. No market structure is showing a range yet. So, we enter our trades based on whatever strategy we are using at the time, forex zones.

Then as we enter the trade, it reverses and touches the other end of a swing low or high. Then we realize the market has formed a range. This is because the markets are not exact and ranges are hard to spot. And even if we spot a range, we are often a little too late.

Often, we see more than a couple of touches each forex zones the support and resistance before we call it a range. Just forex zones we see three or four touches on each side and realize it is a range, ready to pull out our range trading strategies, the range gets broken on the fourth or fifth touch of the support or resistance.

Forex zones is this? Supply and demand traders might have the answer for this. This is because resistances are basically a supply of ready sellers or short traders at a given price area.

And supports are also demand zones of buyers ready to buy at a certain price area. The first visit to that price level, whether a demand or supply zone, forex zones, these traders will enter in. The next visit, those who were not able to get in on the first touch would also come in.

As soon as the either a supply or demand runs out, the range is broken. To do this, we must first understand what most traders would call a range. Many traders would define a range as a market structure with a perpendicular horizontal support and resistance areas, forex zones, with more than two touches on each side. Knowing what we know how other traders think of a range, forex zones, forex zones strategy is to enter the market as a range even before other traders decide it is a range and stop trading it as a range as soon as it becomes a mature range.

How do we do this? We wait for a range with a couple of touches on either a support or resistance and still no defined horizontal support or resistance forex zones the opposite side, but only a swing low or swing high.

Mark the area anticipated to be the support zone from the body of the candle forming the swing low up to a few pips below the wick of the candle. Wait for price to revisit the support zone then watch the price action as it touches it. As price enters the support zone, enter a pending Buy Stop Order a few pips above the support zone, forex zones. The candle after forex zones touch of the support zone should immediately close above the support zone.

Stop Loss : Stop loss should be a few pips below the support zone. Take Profit: Target take profit should be a few pips below the resistance zone. Mark the area anticipated to be the resistance zone from the body of the candle forming the swing high up to a few pips above the wick of the candle. Wait for price to revisit the resistance zone then watch the price action as it touches it.

As price enters the resistance zone, enter a pending Sell Stop Order a few pips below the resistance zone. The candle after the touch of the resistance zone should immediately close below the resistance zone.

Stop Loss : Stop loss should be a few pips above the resistance zone, forex zones. Take Profit: Target take profit should be a few pips above the support zone. As said earlier, ranges are quite hard to trade. We often trade a different strategy aside from a range trading strategy, prior to the market forming a ranging structure, forex zones. Then, as we notice the range, we trade a ranging setup just before the range gets forex zones. I think the key to trading ranges is anticipation, and this strategy helps us trade ranges by anticipating it ahead of the market noticing a range.

Knowing this, many variations could be forex zones using this knowledge. Some supply and demand traders use pending Limit Entry Orders prior to price touching the zone. Forex zones are advantages and disadvantages to this. One is that sometimes the market moves too fast, and if we only trade every candle close we might be a little too late to enter the trade. By using Limit Entry Orders, we are able to enter the market at a good price compared to waiting for the close.

On the other hand, Limit Entry Orders could also be risky since price could sometimes pierce through the zones before reversing. Some also wait for the candle close before entering the trade, forex zones. This would be on the safer side, but it also causes traders to enter a little too late, diminishing the Reward-Risk Ratio. Sometimes, price also bounces strongly, forex zones, the opposite zone is reached with just one candle, just like our sell setup.

Variations and tweaking could be done, but the key to success trading zone based ranges is anticipation. Forex Trading Systems Installation Instructions Zone Based Range Forex Trading Strategy is a combination of Metatrader 4 MT4 indicator s and template.

The essence of this forex system is to transform the accumulated history data and trading signals. Zone Based Range Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. Based on this information, traders can assume further price movement and adjust this system accordingly. Click Here for Step By Step XM Trading Account Opening Guide.

Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform. Get Download Access. You can now download the TPL file. Once you have upload the TPL file, it will auto link up the indicators setting.

Save my name, email, forex zones, and website in this browser for the next time I comment. Sign in, forex zones. your username. your password. Forgot your password? Get help. Password recovery. your email. Home Forex Breakout Strategies Zone Based Range Forex Forex zones Strategy.

Table of Contents 1 Zone Based Range Forex Trading Strategy 1. RELATED ARTICLES MORE FROM AUTHOR. Vortex Crossover Forex Trading Strategy, forex zones. Silver Trend Momentum Forex Trading Strategy, forex zones. ATR Momentum Breakout Forex Trading Strategy. Notarius Moving Average Oscillator Forex Trading Strategy.

Donchian Channel KVO Forex Scalping Strategy. CCI MA Momentum Breakout Forex Trading Forex zones. regards Antony. Hi Antony, Thanks for letting me know! I have fixed this. Cheers, Tim. LEAVE A REPLY Cancel reply. Please enter your comment! Please enter your name here. Forex zones have entered an incorrect email address! Top Download MT4 Indicators List. Infoboard Indicator for MT4 December 17, forex zones, Candle Closing Time Remaining Indicator for MT4 November 10, TMA Slope Forex zones Indicator for MT4 December 17, MA BBands Indicator for MT4 December 17, Renko Charts Indicator for MT4 November 9, forex zones, Forex Trading Strategies Explained.

Forex Strategy — Price Action Strategy Explained With Examples September 23, Forex Bollinger Bands Strategy Explained With Examples September 24, forex zones, How to Use the Forex Factory Calendar with Step By Step March 17, Recommended Top Forex Brokers.

Tickmill Broker Review — Must Read! Is Tickmill a Safe

What Are The BEST TRADING Zones In Forex??...

, time: 18:28Forex Market Hours and Time Zone Converter

· Forex supply zones are areas where banks and institutions are placing a large number of sell positions at a particular price zone. If a portion of these sell orders remain unfilled when price moves lower, then they’re likely to be left there, just sitting untouched When placing a trade in the foreign exchange market, it’s helpful to understand where the buy and sell zones are. Along with trading trends and trendlines, this helps you as a Forex trader to identify potentially profitable Forex trades. Buy and sell zones, generally speaking, exist when a trend has been broken in currency trading 3. · FREE: EMACP Strategy Tutorial-My Breakout Strategy -blogger.com OUT: EAP Training Program - blogger.com Author: The Trading Channel

No hay comentarios.:

Publicar un comentario