The name is largely self-explanatory. A market maker quotes two-way prices in a certain currency pair, thereby making a market. A Forex market maker essentially does three things: Sets bid and offer prices within a certain currency pair. Commits to accepting deals at Estimated Reading Time: 9 mins So how do forex market makers make money? The money-making process for Market makers is not as complicated as their business model would make you think. When the market maker type broker sets a certain exchange rate through their ask and bid prices, they set Estimated Reading Time: 9 mins 17/03/ · Dealers make money by buying lower and selling higher than the price-takers do. However, unlike the price taker, they don’t do this by guessing which way the market will move. The dealer makes a profit by adding a spread, or markup to their blogger.comted Reading Time: 8 mins

How Do FX Dealers Make Money? - Forex Opportunities

A Forex broker is a company that provides traders with access to the foreign exchange market. In essence, Forex brokers are a middleman between Forex traders and the market. They offer a range of services, including trading platformswhich are used to buy and sell foreign currencies. Once you send an order through your trading platform, your broker tries to match the order either with its internal pool of traders or forwards it to external liquidity providers to find the best opposite order, how do forex market makers make money.

Each time you place a sell order, it has to be matched with a corresponding buy order, and vice-versa. Forex brokers, also known as retail Forex brokers, account for a relatively small amount of the daily Forex market turnover.

There are two main types of Forex brokers: dealing desk DD brokers and no dealing desk NDD brokers. All mentioned types of brokers have their own advantages and disadvantages, how do forex market makers make money, which are explained below.

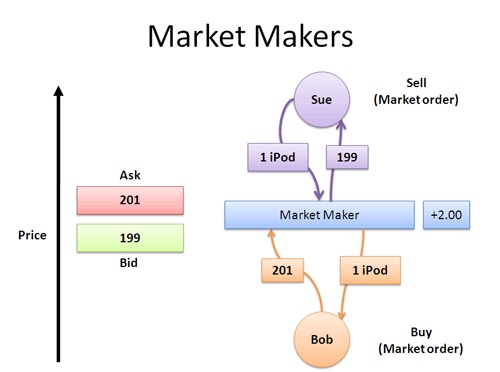

Dealing desk or DD brokers, also called market makers, provide liquidity to their clients and create the market for them. Since dealing desk brokers create the market for their clients, they have the full discretion to set both bid and ask prices of a currency pair.

Also, dealing desk brokers often offer fixed spreads. They simply act as a middleman between their clients and other liquidity provider, either internal or external ones. Once you place a trade with a no dealing desk broker, the broker will first try to match your order with its how do forex market makers make money liquidity pool. If there are no matching orders, the broker will forward your order to external liquidity providers, which can include banks, mutual funds, hedge funds, other brokers etc.

The following graphic summarises the main difference between DD and NDD brokers pretty well. Read: 6 Secret Practices to Watch Out For With Your Broker.

As we already said earlier, some brokers take the opposite side of your trade as they are creating the market for you. Those brokers are called market makers.

However, is it bad or illegal to be a market maker? Absolutely not! Market makers provide a service that people need. Market makers operate in the following way:. The transaction is fully legal. Naturally, the problems start if a market maker decides to cheat you, either because of greed or fear.

Stop-hunting has been a very popular practice among market makers to make extra profits by artificially moving exchange rates to hit levels where a large number of stop-loss orders are placed. Fortunately, stop-hunting has become increasingly rare, especially among regulated market makers. Still, not all brokers make money when you lose. Read: What Subjective Benefits Should You Consider When Choosing a Broker? When opening a trading account with a Forex broker, there are certain things you need to pay attention to.

We recommend you read our guide to choosing broker. There are two types of brokers out there: Dealing desk broker DD and no dealing desk broker NDD. Dealing desk brokers are also how do forex market makers make money as market makersas they create the market for their clients and often take the opposite side of the trade.

While there is nothing wrong with regulated market makers, some of them are notorious for bad broker practices such as stop-hunting. Whichever broker you choose, make sure to do your analysis and to pick the right broker for your trading needs. So, you want to become a day trader and join the hundreds of thousands of day traders who are living in the UK? Then this…. Brokers and traders — two completely different types of market participants, yet one cannot exist without the other.

The forex market is so extensive and widespread it needs to be understood before stepping in. Forex signal providers can be an effective tool for…, how do forex market makers make money. Day trading is one of the most popular trading styles in the Forex market.

However, becoming a successful day trader involves a lot of blood,…. Next: Step 2 of 4. Phillip Konchar March 17, What are Forex Brokers?

Main Types of Brokers There are two main types of Forex brokers: dealing desk DD brokers and no dealing desk NDD brokers. Dealing Desk Dealing desk or DD brokers, also called market makers, provide liquidity to their clients and create the market for them.

Dealing Desk vs. STP — Straight Through Processing STP brokers, as their name suggests, forward your order immediately to external liquidity providers which have access to the interbank market. ECN — Electronic Communication Network ECN brokers are true NDD brokers as they represent the bridge between retail traders and the interbank market. ECN brokers simply provide a sophisticated network that connects various market participants together, such as hedge funds, banks, other brokers and retail traders.

All mentioned market participants trade directly with each other, and the ECN broker charges a small commission for its services. Spread — The spread is the difference between the bid and ask prices of currency pairs.

While some dealing desk brokers offer fixed spreads, most of the time spreads are variable and depend on the current market conditions. If there are important and unexpected news in the market, spreads can widen significantly and increase your trading costs, how do forex market makers make money.

During normal market conditions, spreads tend to be quite low with most brokers, reaching around 1 pip for most major pairs. This is especially true with ECN brokers. However, commissions and fees tend to be quite low due to the high competition among Forex brokers. Trading Platforms — The next major income for Forex brokers are trading platforms.

While many brokers offer free in-house developed and third-party trading platforms, some of them may also charge you for additional features. The main point to how do forex market makers make money is that the offered feature increases your profitability and efficiency more than the cost of the service.

Beginner traders, on the other hand, are likely fine with the range of features offered with free trading platforms. Additional Services — Finally, some brokers may offer additional paid services. For a small cost, you may get access to a larger range of tradable instruments, professional market research, trading signals and market depth information, to name a few.

Read: 6 Secret Practices to Watch Out For With Your Broker Do All Brokers Make Money When You Lose? Market makers operate in the following way: Example. Categories: Industry. Phillip Konchar. Related Articles. Joe Bailey October 8, Phillip Konchar March 12, Phillip Konchar April 28, Phillip Konchar May 22, Phillip Konchar June 2, Request a Free Broker Consultation. Phone including intl. If you are human, leave this field blank. Information you provide via this form will be shared with Forest Park FX only as per our Privacy Policy.

MEMBERS ONLY The My Trading Skills Community is a social network, charting package and information hub for traders. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. Buy community. Any person acting on this information does so entirely at their own risk. Any research is provided for general information purposes and does not have regard to the specific investment objectives, how do forex market makers make money, financial situation and needs of any specific person who may receive how do forex market makers make money. Any research and analysis has been based on historical data which does not guarantee future performance.

Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not be held responsible for any loss that you may incur, either directly or indirectly, arising how do forex market makers make money any investment based on any information contained herein. Trading on leveraged products may carry a high level of risk to your capital as prices may move rapidly against you.

Losses can exceed your deposits and you may be required to make further payments, how do forex market makers make money.

These products may not be suitable for all clients therefore ensure you understand the risks and seek independent advice.

Historical data does not guarantee future performance. I Understand. Then please Log in here. Not registered yet? Sign up here.

What is a Market Maker and How do They Make Money? ☝️

, time: 7:40The Truth About How Forex Brokers Make Their Money - My Trading Skills

So how do forex market makers make money? The money-making process for Market makers is not as complicated as their business model would make you think. When the market maker type broker sets a certain exchange rate through their ask and bid prices, they set Estimated Reading Time: 9 mins 07/02/ · Another way to make money with the forex market is to trade contracts for difference or CFDs. The CFDs represent a derivative trading instrument and they are available for different types of markets such as stocks, indices, commodities and currencies 17/03/ · Dealers make money by buying lower and selling higher than the price-takers do. However, unlike the price taker, they don’t do this by guessing which way the market will move. The dealer makes a profit by adding a spread, or markup to their blogger.comted Reading Time: 8 mins

No hay comentarios.:

Publicar un comentario